As Nigeria continues its tech-driven transformation, one sub-sector has risen to prominence, showcasing unprecedented growth and innovation. The latest data from the Nigerian Bureau of Statistics highlights the remarkable growth and innovation in Nigeria’s tech sector, with the financial technology (FinTech) sub-sector emerging as the fastest-growing. In the first quarter of 2023, the Information and Communications Technology (ICT) sector contributed 17.47% to the country’s GDP, amounting to ₦3.1 trillion ($6.7 billion), representing a significant increase from the 16.2% ($6.2 billion) recorded in the same period of 2022.

Explosive Growth in FinTech Adoption

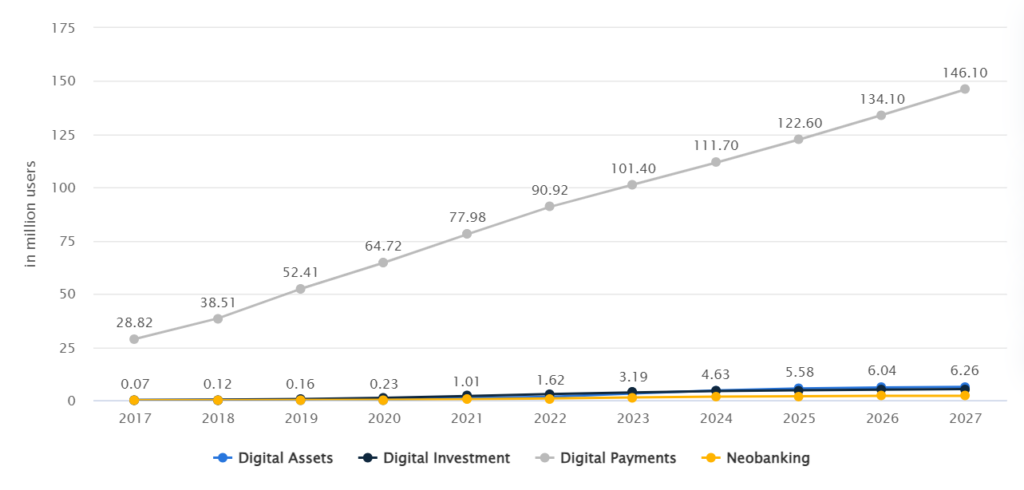

Recent data indicates a remarkable surge in FinTech adoption across Nigeria. The number of users engaging with FinTech platforms for various financial services has witnessed exponential growth, with about 28.82M digital payment users in 2017 to approximately 90.92 million users in 2022 and the this is projected to reach 146.10M users by 2017, reflecting a fundamental shift in the way Nigerians approach banking and financial transactions. This shift in mindset is also very visible in the steady growth of Digital Assets, Digital Investments and Neobanking respectively.

Source: Statista

Mobile Payments Dominance:

The data emphasizes the prevalence of mobile payments in the FinTech arena. Notably, mobile payment platforms, led by industry leaders such as Interswitch, Paystack, Moniepoint, Opay, and Palmpay, have witnessed a substantial surge in transaction volumes. This growth is facilitated by the widespread adoption of smartphones and enhanced mobile network infrastructure. This trend not only indicates enhanced convenience for users but also signals a noteworthy decrease in dependence on traditional banking channels.

Financial Inclusion Metrics:

Financial inclusion metrics demonstrate the positive impact of FinTech on underserved populations in remote areas by seamlessly integrating them into the formal financial system, primarily through the deployment of Point of Sales (POS) terminals. This aligns with Nigeria’s government goals for financial inclusion, showcasing successful technology integration. According to Statista’s 2022 report, nearly 27% of the 173 fintech startups in Nigeria focus on payments and remittances, featuring notable companies such as Moniepoint, Opay, Flutterwave, Paystack, Remita, SeerBit, Interswitch, and Monnify. Moreover, over 19% specialize in lending and financing, with an additional 11% engaged in blockchain activities.

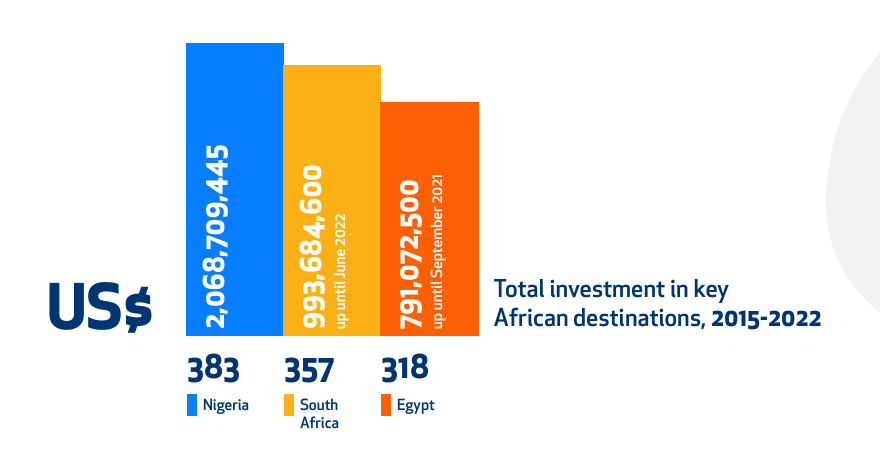

Investment Inflows and Start-up Ecosystem:

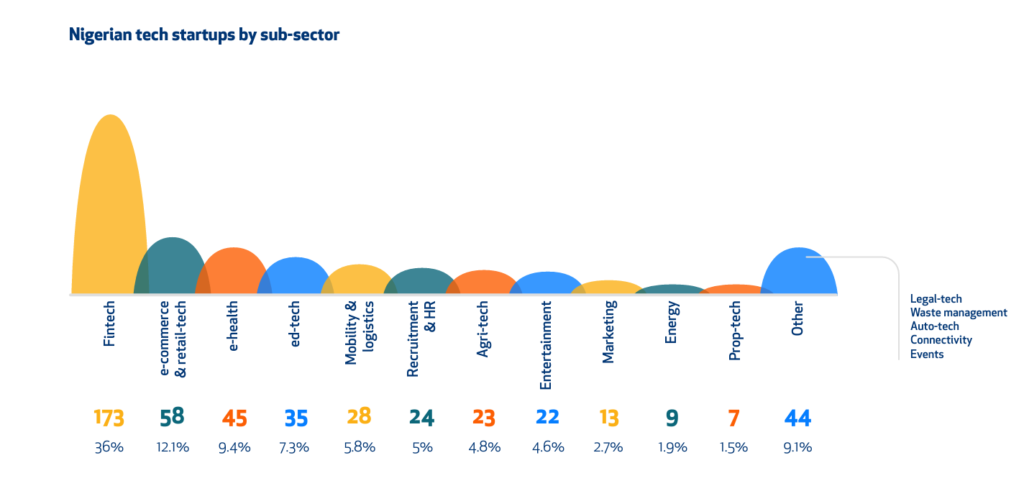

Investment data underscores the attractiveness of Nigeria’s FinTech ecosystem to investors, indicating a strong belief in its potential for growth and returns. The dynamic startup culture, particularly within FinTech, fosters innovation and healthy competition. According to the Nigerian Startup Ecosystem Report 2022, FinTech dominates the startup landscape, excelling in both activity and funding acquisition, with 36% of tracked startups dedicated to this sector—nearly three times more than the closest competitor.

Source: The Nigerian Startup Ecosystem Report 2022

E-commerce and retail-tech follow at 12.1%, highlighting the robust support system for Nigerian startups actively engaging in local or international accelerator and incubator programs. Notably, these startups exhibit a higher likelihood of being selected for esteemed international programs like Y Combinator and Techstars compared to counterparts from other parts of the continent.

Source: The Nigerian Startup Ecosystem Report 2022

Regulatory Support and Framework

Examining the data on regulatory developments reveals a collaborative effort between the government and regulatory bodies to support and regulate the FinTech sector. The establishment of frameworks and policies that encourage responsible innovation ensures a stable environment for both businesses and consumers, further fueling the sector’s growth. This can be seen in creating the Nigeria Startup Act (NSA) that was signed into law in 2022 to support the growth of Nigeria’s startup ecosystem and drive the development of startups and tech-related talents.

In conclusion, the latest data solidifies the FinTech sector as the fastest-growing tech sub-sector in Nigeria. The surge in adoption, dominance of mobile payments, positive financial inclusion metrics, investment inflows, regulatory support, and integration of emerging technologies collectively paint a picture of a thriving and transformative industry. As Nigeria continues to embrace the digital revolution, the FinTech sector stands at the forefront, reshaping the nation’s financial landscape and fostering economic growth.